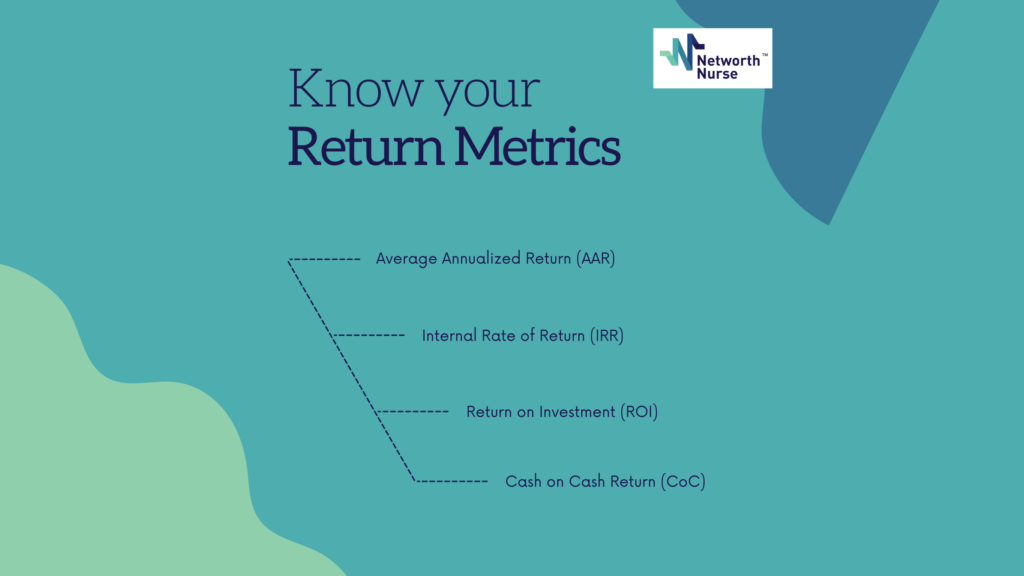

I want to be upfront about things – as a passive investor you have a little work ahead of you. In the world of real estate investing, passive investing requires a lot less work than the role of General Partner. However, being a passive investor does require you to know your return metrics.

A successful passive investor will want to do two things:

- Investigate the sponsor

- Evaluate the deal through return metrics

Again, these aren’t to be compared with the level of time + effort in actually obtaining the deal, but they aren’t to be dismissed either.

As a passive investor, you should feel empowered moving forward with a sponsor and a deal. How do you do this you ask? Well I have you covered. Knowing the most common investment return metrics, how, when, and why they are used, is going to be your golden ticket. This information will set you up for success as you step forward, education is key in the investment process.

Average Annualized Return (AAR)

The Average Annual Return (or “AAR”) takes into consideration the three ways apartment buildings can make money: cashflow, appreciate and amortization.

To calculate the AAR, you add up all three of these metrics, divide it by the number of years you held the investment, and divide that by the amount of cash invested.

This metric is most commonly measured against alternative investments, stock market, gold, etc. We aim for an AAR of 15-20% The average stock market return for 10 years is 9.2%, according to Goldman Sachs data.

Internal Rate of Return (IRR)

IRR takes into account how much money you put into a deal when it begins. This can include distributions, any proceeds from a cash out refinance or sale, and then combines them all together into one macro-return.

This return is then adjusted to account for the time that has passed between when you invested the money and when you receive the returns.

One important driver of IRR is when you receive the money. Time Value of Money is an important concept you will want to understand as an investor. Receiving $5,000 now is better than receiving it in a year from now because of inflation + usability. Next year, $5,000 has less buying power than it does today.

IRR allows for us to quantify how much more valuable it is to receive your $5,000 today than it would be next year.

Return on Investment (ROI)

ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.

To calculate ROI, the benefit (or return) of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio.

For example, suppose you invested $1,000 in cryptocurrency in 2017 and sold the shares for a total of $1,200 one year later. To calculate the return on this investment, divide the net profits ($1,200 – $1,000 = $200) by the investment cost ($1,000), for a ROI of $200/$1,000, or 20%.

With this information, you can compare the investment in cryptocurrency with any other projects. Suppose you also invested $2,000 in your friend’s dog-walking business in 2014 and sold the shares for a total of $2,800 in 2017. The ROI on your investment would be $800/$2,000, or 40%.

Appreciation

We are grateful for you and care for you but we aren’t talking about that kind of appreciation here. To be completely honest, this isn’t actually a return metric, but we do agree this is an important concept to grasp.

For any homeowners out there, this may be a familiar term. You have quite likely seen the value of your house increase over time, aka, appreciation.

In simple terms, appreciation is an increase in the value of an asset over time.

We recommend that you don’t put all your eggs in the basket over appreciation. Although it is important to consider it can be a bit unreliable. In markets that are currently experiencing strong economic and population growth, the rate of appreciation will be significantly higher than in markets with weak economies and a net-loss to population.

This can even be seen in towns right next door to one another. There are examples of one town seeing appreciation growth of 12% while a bordered town is only at 5%.

Again, a good number to inquire about but not your main entree.

Equity Multiple

Although this is not the most important, it is still valuable to consider.

To play this one out, say you put $200,000 into a deal, and over the course of five years you receive a total of $400,000. This would mean you have an equity multiple of 2X.

It’s important to consider that this number is influenced to a great degree by the length of the hold.

This number may be thrown out there because it is quick and easy but it shouldt be the primary metric to use to decide if to fund a deal or not because of the dependence on the hold period.

Cash on Cash Return (CoC)

Cash-on-cash return measures the amount of cash flow relative to the amount of cash invested in a property investment and is calculated on a pre-tax basis.

Say you invest $100,000 in a multifamily syndication, and you receive $7000/year – that’s a 7% CoC return.

It’s a simple formula, but it’s important to know how to calculate cash-on-cash return in order to be a successful investor, it is one of the most common metrics measured. Most people are looking at his return metric to identify how much cash is put back into their pocket every year – and considering “passive income” is a major motive to get started investing, this is important!

Conclusion

These are some basic terms we recommend a passive investor become familiar with. Again, you aren’t driving the car, however you don’t want to arrive at the wrong destination as a passenger either. Stay empowered by walking into a deal with these terms and you’ll be golden.